Award-winning PDF software

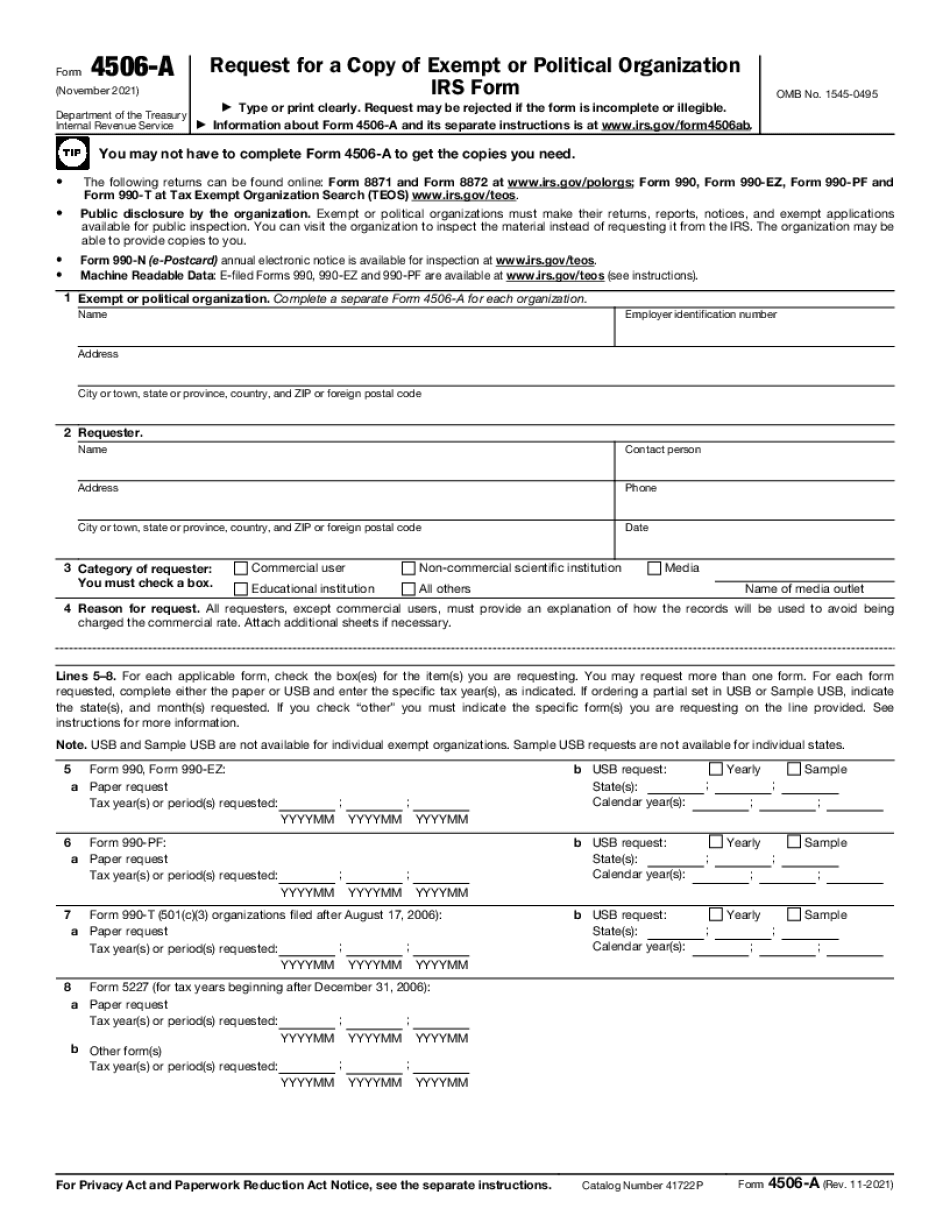

Nampa Idaho Form 4506-A: What You Should Know

Call, Monday–Friday, 9 a.m. to 4 p.m. All other questions should be directed to The Idaho Tax Commission, P.O. Box 131046, Boise Idaho 8346. Telephone inquiries are accepted only between the hours of 7:00 a.m. and 8:00 p.m. Central Time. You should call on business days, as the system is designed to work 24 hours a day. Payment of Idaho state sales tax is required, in the same manner as any other out-of-state business. Note: Any income from sales activities is exempt from state income tax. Idaho's residents and nonresidents may file an application to a Tax Commission officer to determine whether you are exempt. However, no tax exemption is given by this agency to any person or group, except where the application is accompanied by an affidavit of exemption by a person or organization. Application for Certificate of Exemption A person or organization must apply for a certificate of exemption before a transaction in any trade, business, profession, or occupation under the Idaho Code or Tax Division's rules is completed—for example, a person must pay a tax on an income or other asset obtained through a trade or business in accordance with Idaho Code or Tax Division's rules; a professional must pay a tax on property acquired under a contract. There are penalties and interest in failure to provide such information and an application may be refused unless the exemption certificate is obtained. The application must include any: • Name, address and social security number of the person or organization • Identification of the person or organization's owner • A statement certifying that the person or organization has applied for a tax exemption for any of the following: • Business income from a sale of property • Income from a business activity or trade • Income from a rental investment • Income from a farm income business • Income from a farm or ranch income activity • Income from a rental business • Income from personal or business insurance • Income from a business activity that is not a trade or profession • Income from personal or business trusts, estates, and the gross income of any trust, estate or the amount of income received from the assets thereof Source: Idaho Code § 5-11-103(3)(d). See FAQs What types of exemptions are considered tax-exempt? (3)(a)-(d) of IRC section 501(c)(3).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Nampa Idaho Form 4506-A, keep away from glitches and furnish it inside a timely method:

How to complete a Nampa Idaho Form 4506-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Nampa Idaho Form 4506-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Nampa Idaho Form 4506-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.