Award-winning PDF software

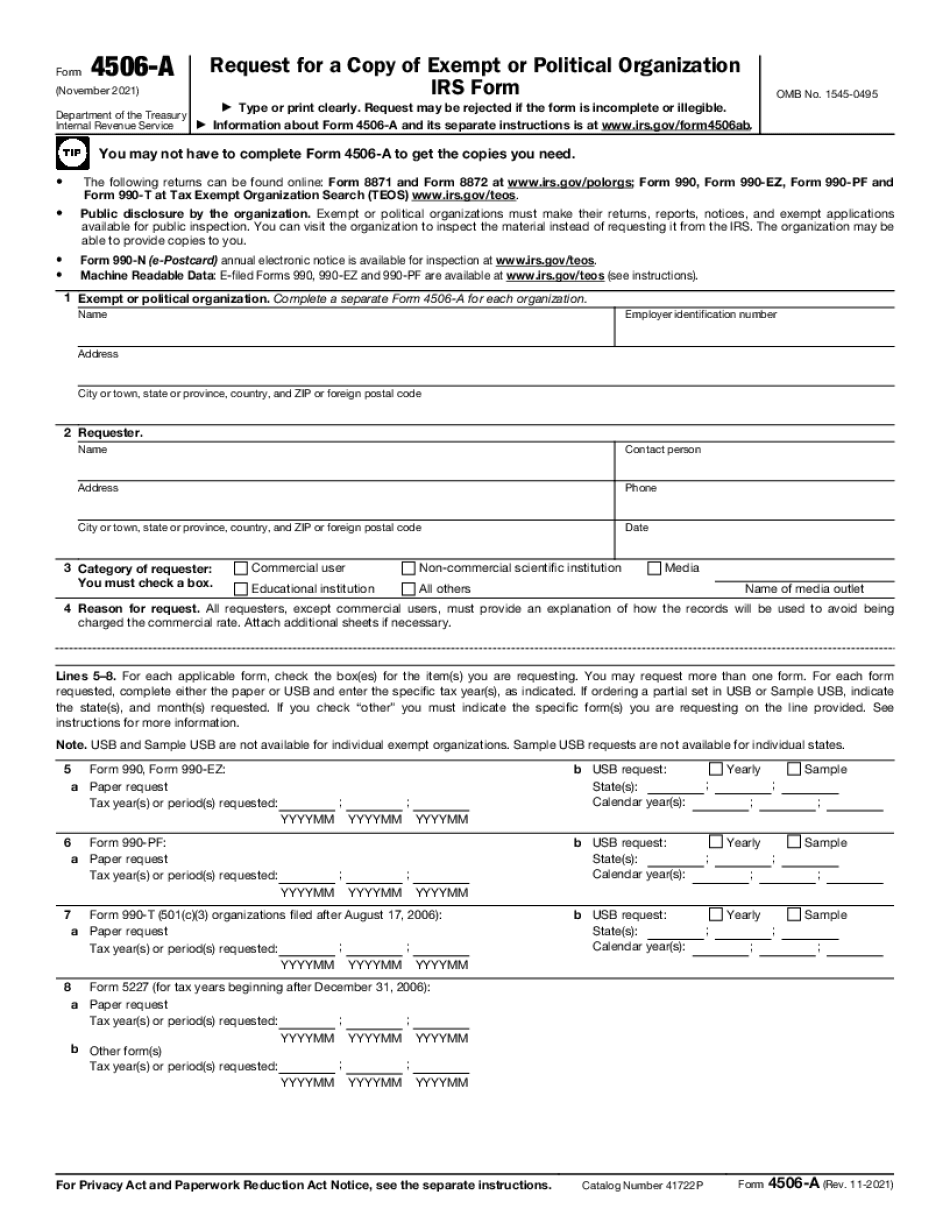

Form 4506-A Irving Texas: What You Should Know

Restaurants that have been operating for five years or more must have an approved IRS 501(c)(3) letter on file. Some cities and counties have special provisions to allow these restaurants to be used. If a restaurant is not eligible for special relief, it is ineligible for RRF. A Restaurant Revitalization Fund or RRF is a special fund of a corporation, business, or cooperative. The fund invests the owner's or individual's business income or capital, then invests the remainder in a common venture. RRF is administered by a State or local governmental authority, a charitable association, or a state or local tax collector or court. The RRF can be used to repay a portion or all of a business owner's investment or invest in property. Irving's restaurants have to file a separate Form 4506-T to have their RRF. Irving Restaurants All non-corporate businesses, no matter how big or small, who employ five or more individuals, are required to file Form 4506-T with the IRS. No exceptions. To file Form 4506-T, you must be an individual, not the manager of the business. If your restaurant employs less than five workers, then you do not have to file form 4506-T. This applies for restaurants with three or six employees or an unlimited number of employees. Business owners wishing to use their RRF in order to qualify for investment may contact us to find out if you qualify. Learn more about the restaurant Revitalization fund. Business Name. This is your company or group that you own. If your business sells merchandise, you must include your company's name and address on the form. The IRS will generally use your company name and address when responding to your request. However, there are certain situations that may cause us to use the business name and address of the business's owners. For example, we may request that you use a business name and your employer's address to determine your eligibility for an RRF under IRC §6410(b). The business name that we will use is: You can use the business name that you use in a written proposal when you file with your state or county government. The IRS does use the business name and address to determine your eligibility. You won't, however, be able to claim the benefit without it. If you file Form 4506-T to report your business income, you don't need to do anything.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A Irving Texas, keep away from glitches and furnish it inside a timely method:

How to complete A Form 4506-A Irving Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A Irving Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A Irving Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.