Award-winning PDF software

Form 4506-A for Georgia: What You Should Know

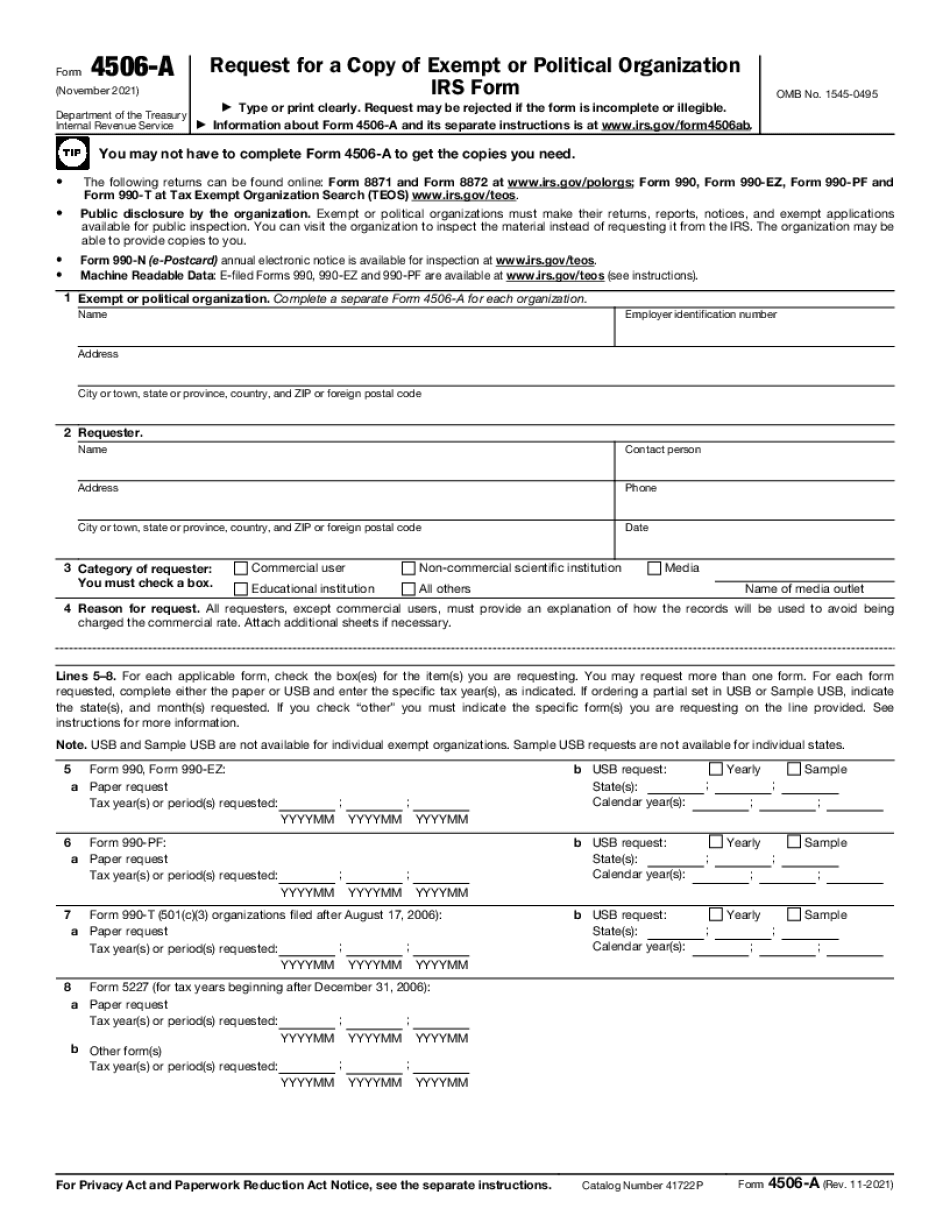

You can then easily print this form. The following is a brief sample showing an applicant listing their names on the form. Note the following for the complete Sample: Name of employee First Initial Last Initial Phone Number of employee Address of employee Postal Code of employee Telephone Number of employer City of employee County of employer State of employer Zip Code of employee. The sample requests the following information, by listing the name and other identifying information: Exempt Status Taxpayer Identification Number (TIN) Number of employees Tax Exemption code(s) Date of return Amount of tax Employer Identification Number (EIN) Other information on the Form 4506-T (if available) Payments Made Please pay a Form 4506-T by using our automated self-help service. A credit card or American Express card will be charged. Note the following for the complete sample: Name of employee. Payments made. Fiscal year the payments were made. Date those payments were made. Amount paid for employee. Name of the other person making the payments. Fiscal year the payments were made. Date those payments were made. Amount paid to other person. Form 4506-T — Business Expenses Form 4506-T Payment Request — Arkansas Department of Revenue Form 4506-T Payment Request — Delaware Division of Labor and Workforce Development Form 4506-T Payment Request — Georgia Department of Revenue Form 4506-T Payment Request — Kansas State University Forms — Kansas Division of Finance Instructions for Form 2115 Report of Charitable Distribution. See Form 4506-Q, Request for Copy of Social Security Number (or Taxpayer Identification #), for more information. Arkansas Department of Treasury and Office of the Attorney General. Forms for Form 2115 Form 2115 — Report of Charitable Distribution. Arkansas Department of Treasury and Division of Enforcement. Arkansas. Department of Administration and Revenue (Arlington, Georgia location only). Instructions for Form 2105 Employment Tax Return. See the product list below: Form 2105 — Employment Tax Return. Arkansas Department of Treasury and Division of Enforcement and Enforcement's Wage and Employment Investigations Unit. Instructions for Form 8058 Wage and Tax Statement. See the product list below: Form 8058 — Wage and Tax Statement. Arkansas Department of Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete A Form 4506-A for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.