Award-winning PDF software

Form 4506-A Florida Hillsborough: What You Should Know

Notice of Default on Tax Refund (Form 6355) The State of Florida maintains a list of notices the Taxpayer must deliver by the end of each calendar month to the Commissioner for the payment of tax. The Notice of Default is attached to the back of the Tax bill. This notice is served to all non-exempt, non-qualifying individuals or entities filing a return. If you are seeking a payment of tax due, it is possible that the non-exempt, non-qualifiable person or entity that is the subject of the Notice of Default is a non-profit 501(c)(3) organization. Contact your local Florida Attorney General or Clerk of Court to assist you in finding and securing payment of tax due. If this form is served to a non-exempt, non-qualifying individual, they can be issued a TEC and a TEC is a way to avoid payment of tax while you seek assistance to pay the balance of your tax bill. There are two ways to complete or obtain a TEC from the Court Clerk's office: Service on behalf of another individual Serving notice on another individual on the TEC form Service on your Attorney General requesting a payment from the Court For more information please contact your local Florida Attorney General's office for assistance. Note: Please be aware that a single Notice of Default will not apply to all individuals and entities listed below. If, for example, you have an entity address listed in the name of your employer, the Notice of Default will be served on you, even if you do not work for the employer. If a Notice of default is served on you, please allow enough time for your attorney to review it and arrange for a payment in order to ensure you have adequate funds to continue with the court filing and appeal process and to be a healthy, solvent parent to your child for years to come. This is especially true if you know the entity address listed on your return is not an entity address; however, you may still be a taxable entity for the IRS, and you should work to resolve the situation in an efficient and timely fashion. If you have any questions or concerns regarding this process, please contact the Court Clerk's office for assistance. The following is intended to assist you in resolving issues and in preparing to answer a Notice of Default.

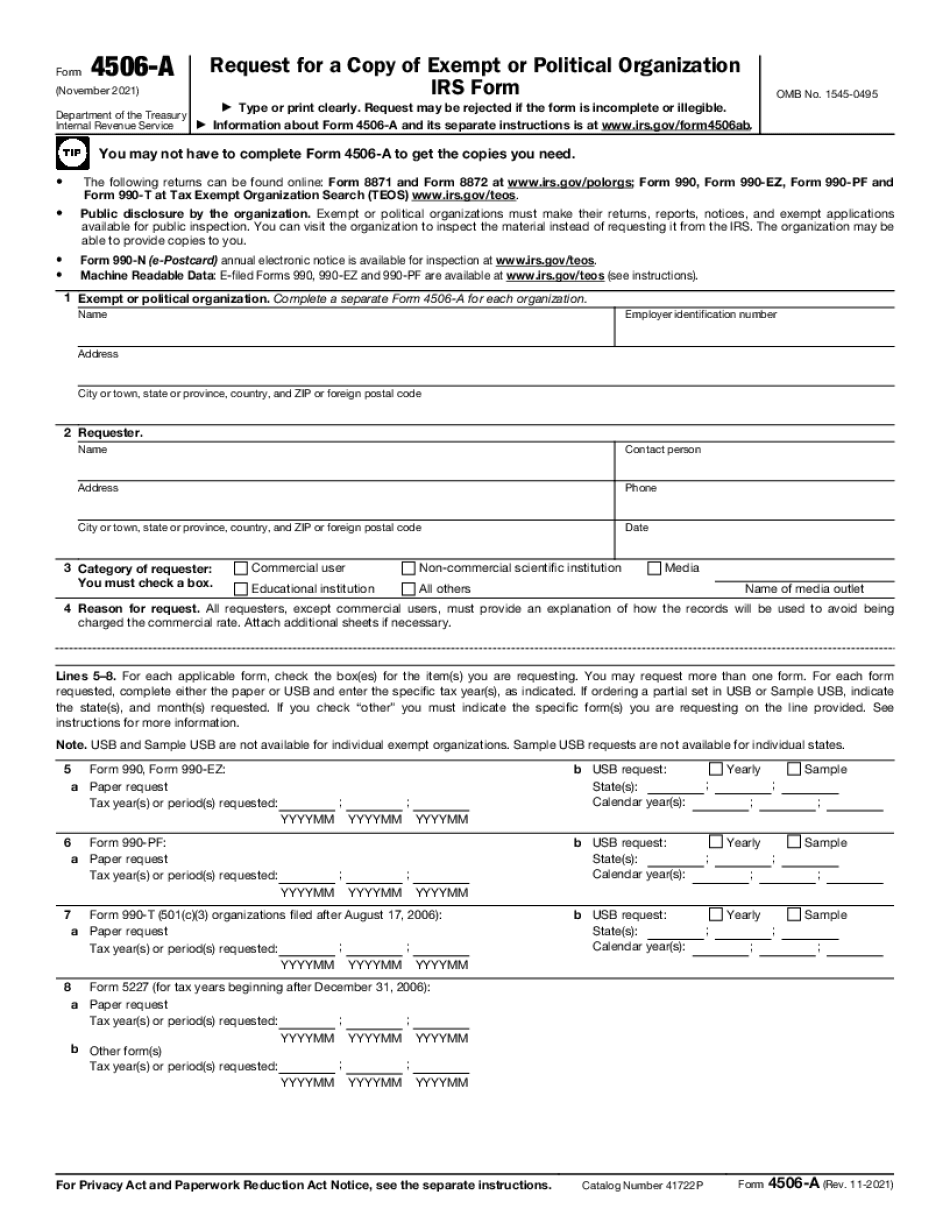

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A Florida Hillsborough, keep away from glitches and furnish it inside a timely method:

How to complete A Form 4506-A Florida Hillsborough?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A Florida Hillsborough aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A Florida Hillsborough from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.