Award-winning PDF software

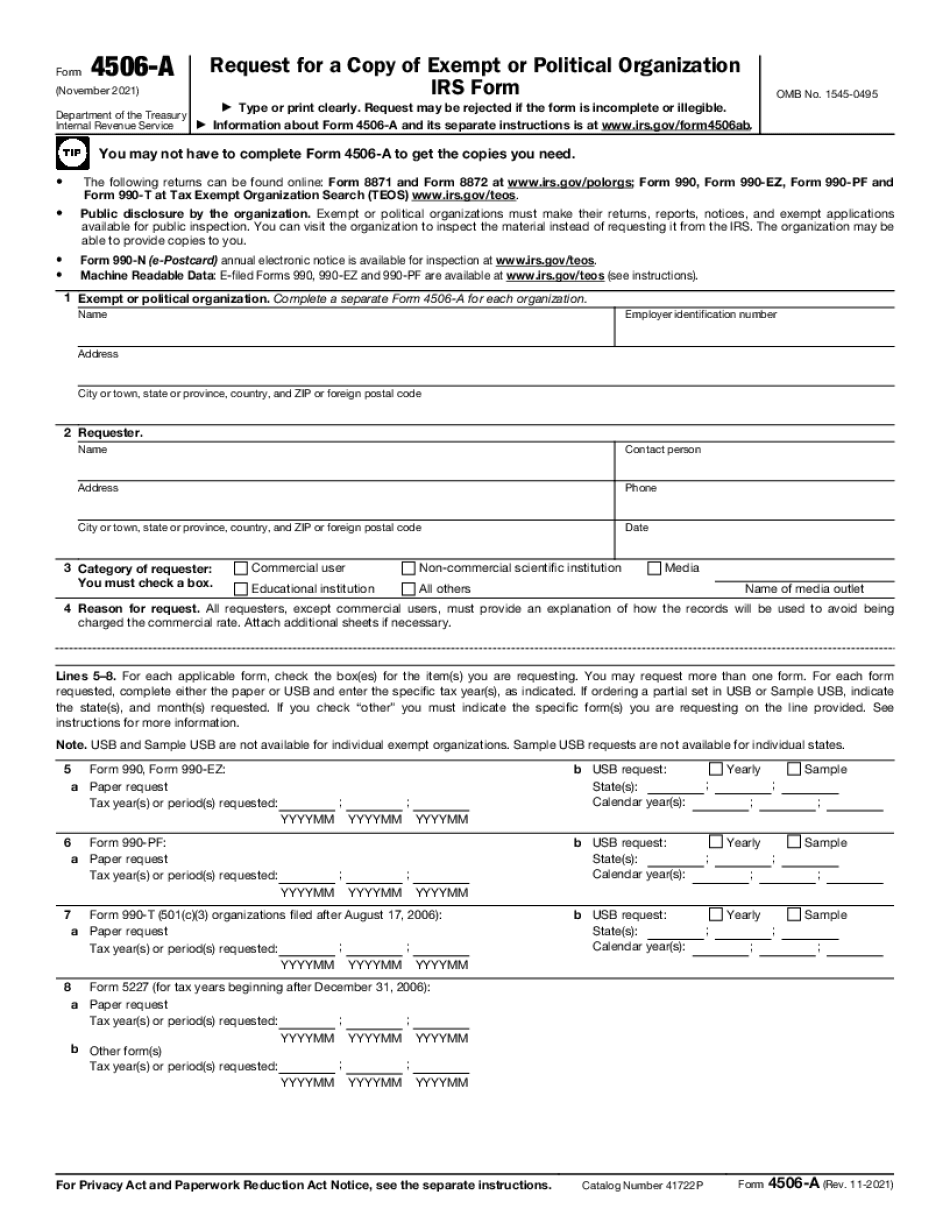

Printable Form 4506-A Las Cruces New Mexico: What You Should Know

The PDF versions are more than sufficient. If you have already filed your return, go online and print or save it and email it to the office for processing. Keep additional copies for your records. Make sure all information is correct. Also, check to be sure you have not double-typed (the IRS doesn't approve the return at the end of the year). The Kansas filing deadline is April 15 by 5 p.m. Eastern Time. If you filed your return in another state or for a foreign country, go to and get a Maryland transcript if you haven't already. Transcripts are free, but you may be charged for postage. Please check with the Kansas Revenue Department. Transcript must be received before the date of a payment. If you filed your return without a transcript, the IRS will send one. Taxable Year 2025 and earlier Personal Income Tax return forms are due by 5 p.m. Eastern Time June 30, 2018. Taxpayers must use PDF Form 4506-A for Kansas and form 4506-T for Kansas and Missouri (PDF) for Kansas and Missouri. Receipt of Return Filing the return electronically is a quick and convenient way to file your return and have it processed before the due date. Use Electronic Filing or Paper Filing Paper forms are more complicated, but if you can fill them out accurately, using the paper forms saves you a lot of money and time. If you use the paper forms, it is even better if you print them out and bring them to your local tax office to fill out and scan, and print them and have them mailed to you for the actual filing. The return filing option is also the most convenient method of checking or responding to the return. In addition to saving you time and hassle, the paper returned to you will allow you to keep documents that are helpful in answering your questions. The return received electronically has a higher likelihood of being answered. For more information on these two methods, go to: What are your filing options? See the list below. Filing With an Employer If you are a resident of Kansas with a wage or salary employment, complete a Kansas wage statement (or income tax statement) to report your gross wages and gross income from Kansas employment. If you do not have a wage return, complete Form W2 (employee withholding report) and have it filed with your Kansas tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 4506-A Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 4506-A Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 4506-A Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 4506-A Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.