Award-winning PDF software

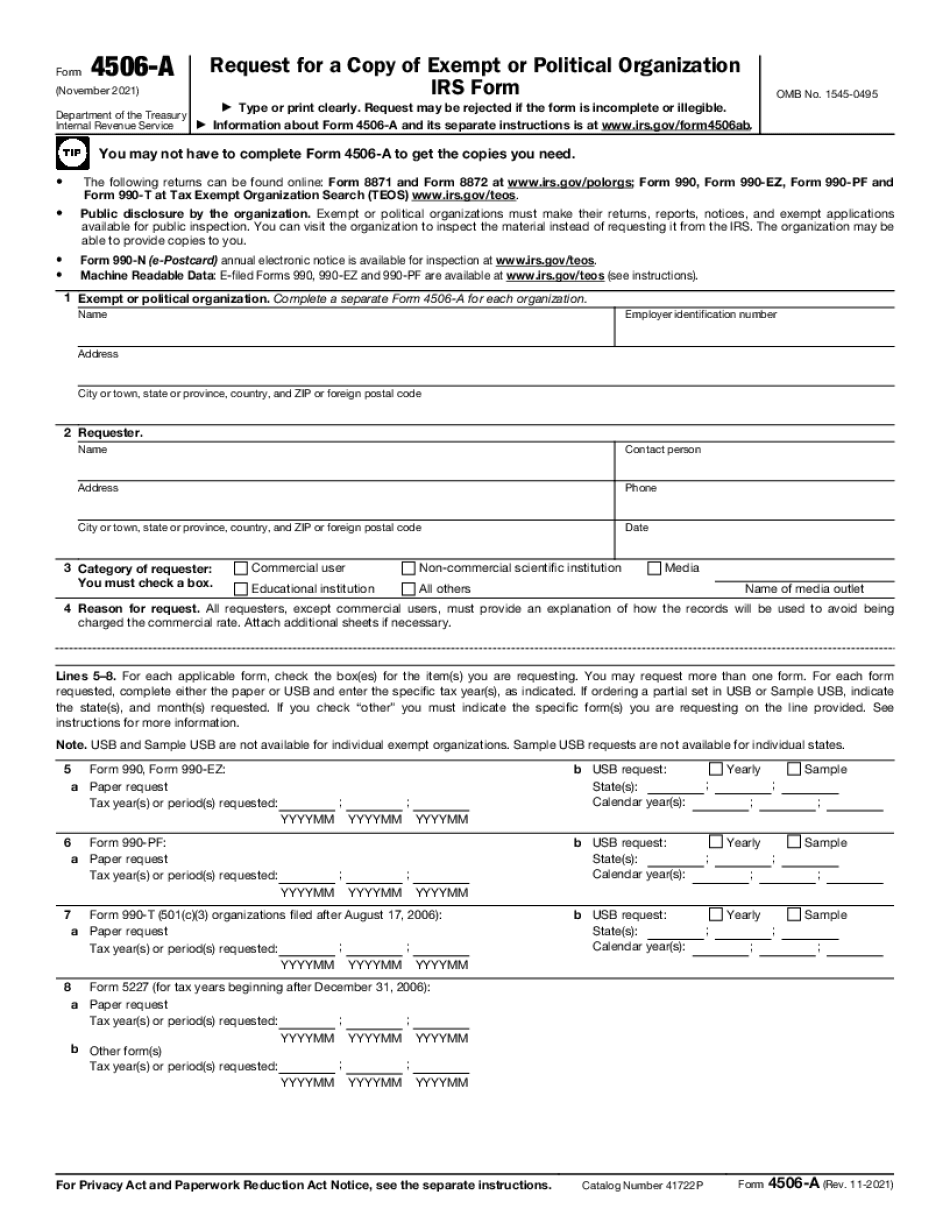

North Las Vegas NevadA Form 4506-A: What You Should Know

Prepare a copy (see the “Fill out the form to get a copy” section at the back) of the tax forms and other required documents and send the package by USPS to the address listed below. Fill out only the sections you need by hand or using the form online at Formssupport.com. All forms and associated forms are posted at the tax office where you submit your form to determine the appropriate application fee. In your city's county tax records. Step 4: After mailing required documents your complete copy will be mailed to your county tax department. Note: If you want a transcript, send us a letter with the document(s) you want a copy of (this includes the Form 4506, e-ZIP and IRS.pdf forms), a cover letter saying you need a copy of the copy, and include a return postage prepaid envelope, make sure the envelope is marked ``Return Required.'' All mail to the following location addresses: County Tax Records CITY NAME 1850 E RIVERSIDE DR APT 1820 Cedar Rapids Dear County Tax Records Attn: IRS Tran scripting I need a transcript of the information on my return filed on March 2, 2018. I received a Form 1099-C from the business in January and thought that may have been my original return to receive the refund. Do you have such documents? Will you please allow me to request a transcript copy? Thank you for your attention to this matter. Yours, Cindy Jones Cedar Rapids Step 5: Wait! Notify the county tax office that you have received the necessary documents. You may also need a letter saying the document you requested was received. Include both the name and address for the county tax agency and your tax ID/Social Security Number as an exhibit. If you are the return preparer, it is important that you get the documentation and copies and send the copies to the individual(s) who are in a position to receive them if you decide to dispute whether the return was in fact received! Step 6: Ask for a copy of the tax information form you were asked to fill out. Cedar Rapids Iowa online Form 9002-A (Tax Information and Request for Copy) When you are issued the form from the IRS and want a copy, we recommend you provide the document with a cover letter saying you need a copy of the copy and include a return postage prepaid envelope.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas NevadA Form 4506-A, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas NevadA Form 4506-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas NevadA Form 4506-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas NevadA Form 4506-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.