Award-winning PDF software

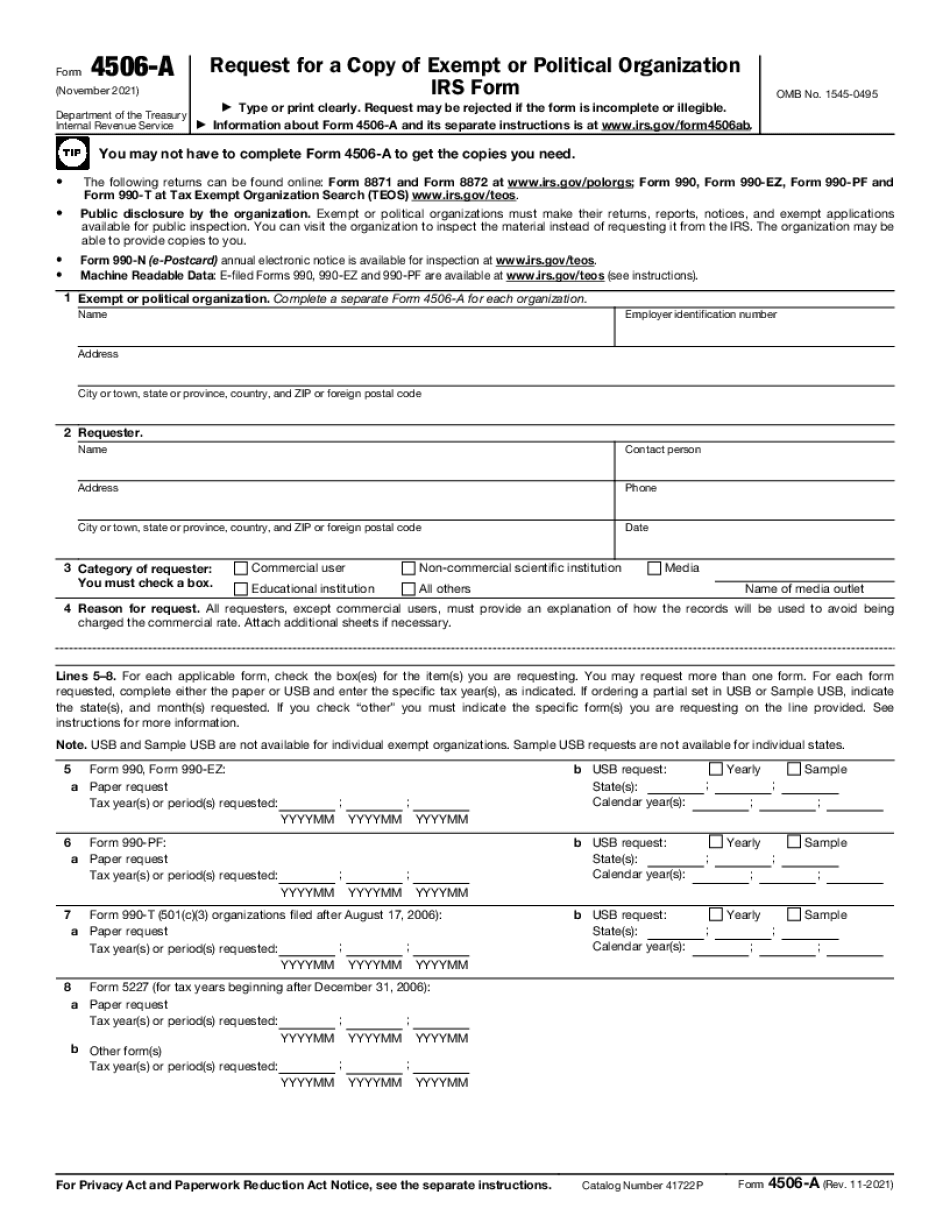

Lee's Summit Missouri online Form 4506-A: What You Should Know

No fees to file. 2. The fees reduce the amount of the tax for the taxpayer. 3. The public has a first right to inspect the books and records of the treasurer. 4. The City receives more tax. How the IRS determines whether a taxpayer will qualify for the exemption is: 1. If the taxpayer claims the exemption on Form 2106 with correct documentation on it, Then the IRS will determine whether the taxpayer is a qualified organization. The exemption would have to be claimed again on Form 8283 if the taxpayer wants to continue to be exempt by simply doing so each year. The IRS will ask for an amount that does not exceed the fair market value of the property (not including insurance) owned by the taxpayer. It would be the taxpayer's responsibility to assess if it is necessary to claim another tax exemption. The exempt organization can then file an application for this exemption. The IRS will send the application to the applicant. The tax exemption will be issued if a tax liability is calculated. The amount of exemption is based on the fair market value of the property on the date the organization applied for exemption. The taxpayer must keep the receipt of the exemption. The taxpayer is required to use the exemption amount each year at the time tax is due. It must be maintained by the taxpayer in a separate account for use during tax year. The taxable value is the tax that is due. After the exemption expires, tax is due on the amount over the exemption amount. The taxpayer would have to pay tax on amounts that exceed the amount of the exemption. What happens if there is a failure to make an exemption (Form 8283) for the year? If more than 10% of the property is in the hands of the exempt organization, the organization will not be eligible for the exemption and the balance of the property will become taxable property. However, before any tax liability is generated, the organization's financial information will be shared and the Internal Revenue Service will conduct a determination regarding the exemption. If the organization claims the exemption without supporting documentation, it will not be granted. Please see Form 8283 for more information. What information is required on Form 8283 or Form 8284? Any organization will need to submit information to prove its exemption. It must be verified through • A completed tax exemption application form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lee's Summit Missouri online Form 4506-A, keep away from glitches and furnish it inside a timely method:

How to complete a Lee's Summit Missouri online Form 4506-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lee's Summit Missouri online Form 4506-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lee's Summit Missouri online Form 4506-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.