Award-winning PDF software

Form 4506-A Salt Lake City Utah: What You Should Know

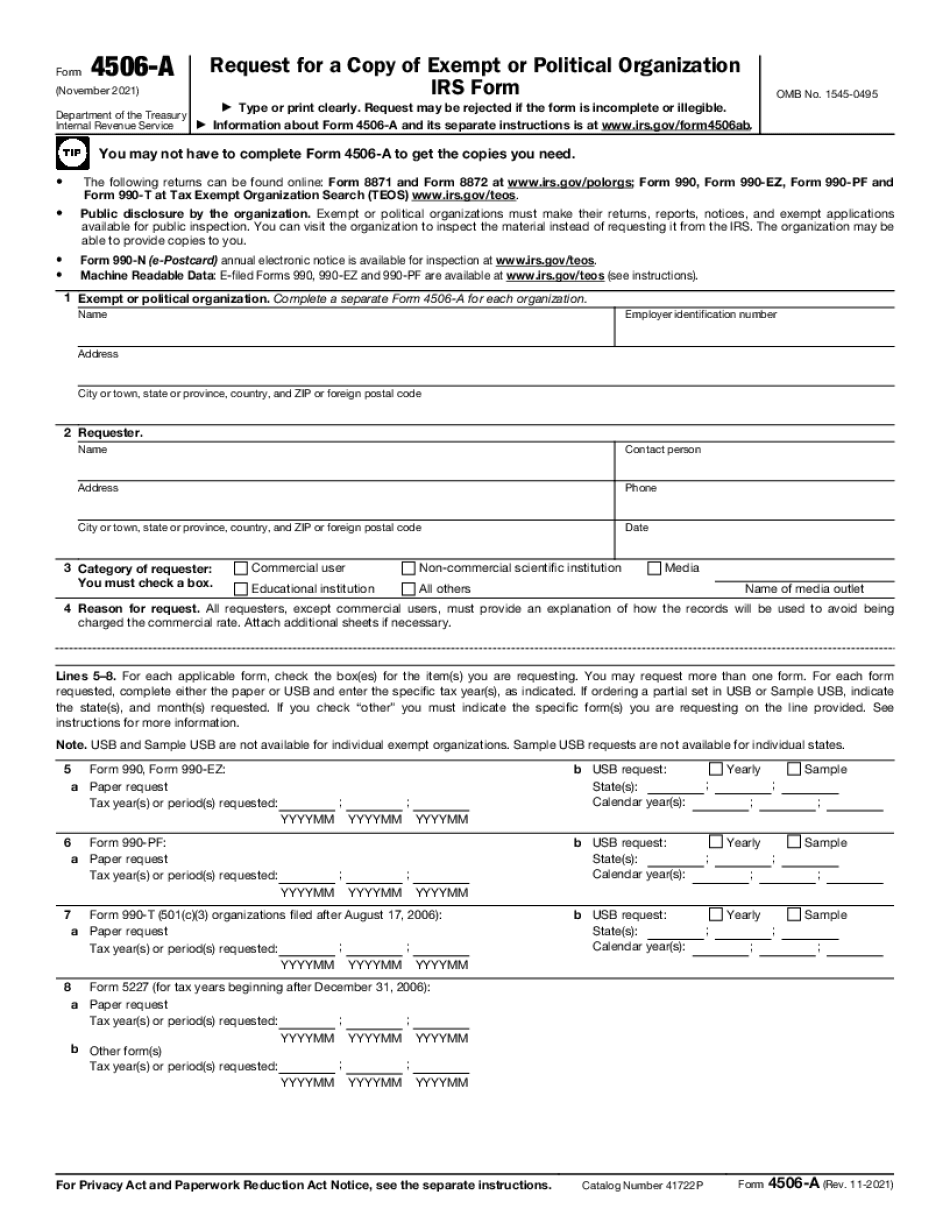

Use Form 4506-T Online to request a copy of your IRS return and an IRS Record of Account Record of tax year 2018, tax year 2017, tax year 2016, tax year 2015, tax year 2014, tax year 2013, tax year 2012. Your complete tax return and IRS record of account are available to view online in the same way as filing paper forms. It requires a valid e-file e-file e-file. Use e-file to complete Form 4506-T and send it to: IRS, Taxpayer Identification Number (EIN): 47-0687855 Filing Instructions to Complete Form 4506-T • Fill out IRS Form 4506-T online and complete a separate form for each form of identification for each individual on the original and the return for each income source. The form must include: name and birthdate. Social Security or other taxpayer identification number. A valid e-mail address. • The e-mail address must match your account on file with the IRS. Please note: It is a good idea to use a public e-mail. It makes it easier for us to find you when we go out to collect payment. Use the e-mail on file. If e-mail is your only way to receive us, then I suggest using either Gmail () or Yahoo (Yahoo.com). We will provide instructions on how to get a free account. • You need to include a copy of your original or the return for each income source and type of income. If you have a paper copy of the return, you only need to supply a copy with the e-file e-fill. Note that the original return is NOT your proof of exemption. • The copy of the return should be in a separate sealed or plastic “trash bag.” • Fill out IRS Form 4506-T. • Attach the paper copies of your return along with tax stamps. • Be sure to sign “I hereby declare that the information contained herein is true, complete and correct.” How We will Do Tax Calculations IRS Tax Calculations • There are four stages to determining any tax due: • Determine whether your gross payment for the payment year is greater than or equal to the payment limit. • Determine the payment limit for the year. • Determine the standard deduction for the year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete A Form 4506-A Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.