Award-winning PDF software

Form 4506-A online West Covina California: What You Should Know

It applies only to creditworthy applicants who are located in the City of West Covina and has an existing credit history. This written policy does not override the terms or conditions of the credit agreement between the City of West Covina and any third party. If you are not creditworthy or have not received credit in the last 12 consecutive months, you will be screened by using a credit scoring tool or a “black box” scoring system designed to prevent fraudulent applications. Applicants whose credit has been deemed to be “at risk”, “risky” or “high risk” may be ineligible to file a personal check with West Covina. “Credentialed” or “certified” individuals applying for employment or government contracts are also not eligible to apply for credit at West Covina. If you have questions about the application process or any other application for employment, please contact the West Covina City Manager's Business Office at or bmskwestcovina.org. Appendix C “No Public Funds Allowed” Statement of Eligibility Requirements All credits based on an applicant's current credit history are based on the total of a taxpayer's outstanding tax liens and delinquent accounts, not simply the balances on those accounts at time of application. For more information, please refer to page 476 of the Application Verification Summary on the California Department of Fair Credit Reporting website. All applicants must state in an application that they are “no longer accepting public financial assistance”. This requires applicants to disclose any public financial assistance grants of grants/grants or the equivalent (such as a grant/grant from a state, local government or an organization) received during the previous 24 months. Tax liens are those debt obligations the IRS has collected against current or former taxpayers. These liens include the following: The IRS has assessed a tax bill against you, You owe taxes and/or delinquent tax payments due to the IRS for an assessed tax bill You are assessed taxes by the IRS from which it still has income You owe taxes for which you are delinquent and have not been made whole by the IRS in full or in part since the delinquent debts occurred In all cases, if an application to participate under a project or program at the City of West Covina does not specifically ask for the disclosure of the application of public funds, any public funds provided will not be considered in assessing a debt against such applicant.

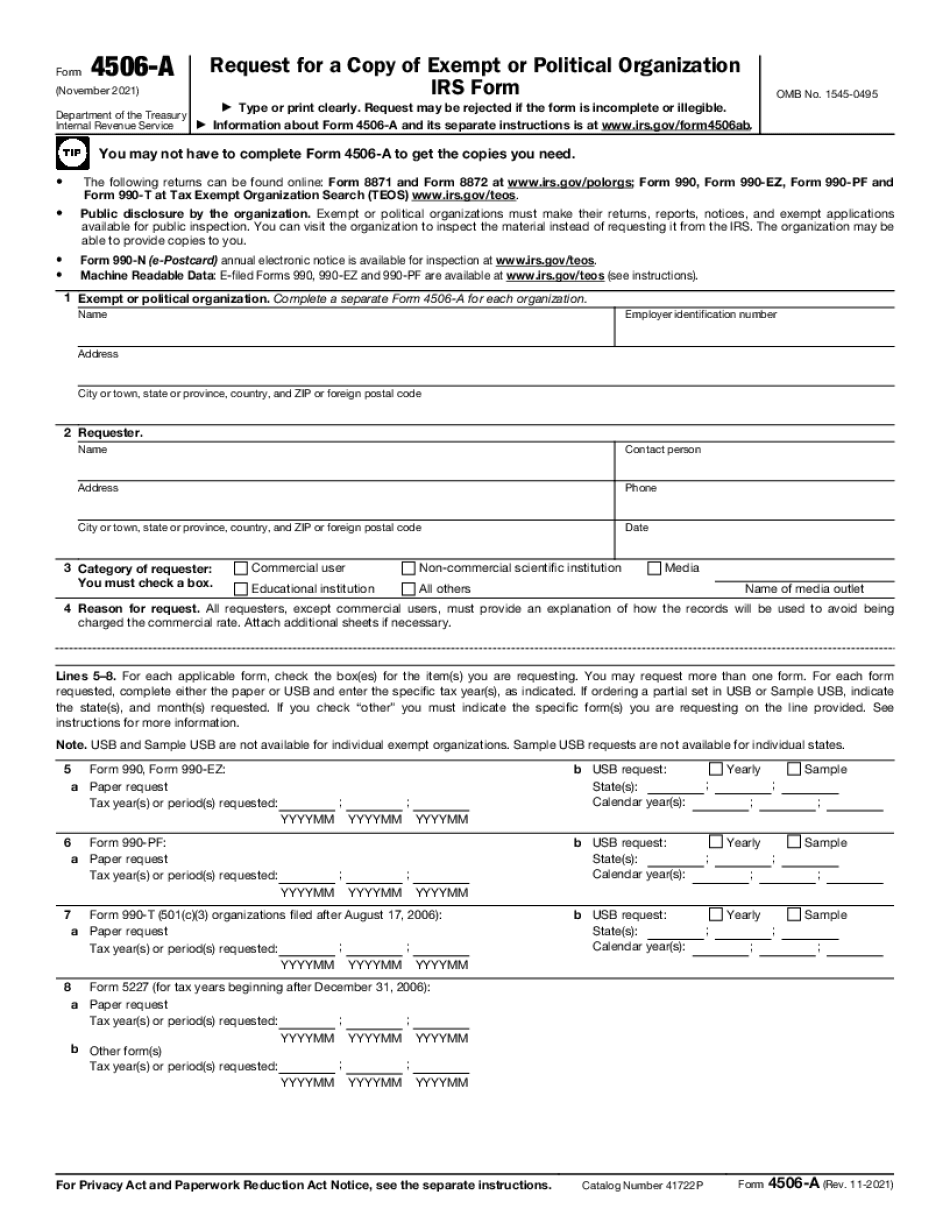

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A online West Covina California, keep away from glitches and furnish it inside a timely method:

How to complete A Form 4506-A online West Covina California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A online West Covina California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A online West Covina California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.