Award-winning PDF software

Form 4506-A El Cajon California: What You Should Know

If you received a letter in the mail about your tax due date that has not been paid, do not hesitate to ask if you have received approval for a COVID-19 IDL disaster loan. IRS Form 460 — U.S. Bankruptcy Trustee IRS Form 460 is used to obtain financial information about a bankruptcy filed in bankruptcy court. The information includes the filing status, the amount of money owed, and the date and amount due. It will show the debtor's name, address and income. Popular Forms · U.S. Trustee's Affidavit of Receipt for Bankruptcy Trustee's Report of Assets and Liabilities. · Federal Tax Returns · Chapter 13 or Chapter 7 · Bankruptcy Release and Release of Claims Form 4641-X — Notice to Seller The Form 4641-X is a document sent by your mortgage lender to sell properties to recover the money in a loan, and it can take anywhere from 4 to 12 months to be processed. The deadline to submit the property application forms for your home is October 18th. You will need the tax forms for any previous home sales in California. Popular Forms · Notice to Seller · U.S. Bankruptcy Trustee's Affidavit of Receipt for Mortgagees Report of Assets and Liabilities. IRS Form 4506-T — SBA This form provides permission to provide information about your SBA IDL disbursement requests to the IRS, if you applied for and received a COVID-19 IDL disaster loan. The process The most common use of this document is to determine eligibility of someone who files an affidavit for a COVID-19 IDL disaster loan or is requesting IDL disbursements for the borrower. Form 4506-T is also used to determine eligibility for Chapter 13 or Chapter 7 bankruptcy, and to request IDL disbursement requests. What forms are needed to apply for a COVID-19 IDL disaster loan This list is not intended to be an exhaustive list of the forms needed to apply for a COVID-19 IDL disaster loan. This information should only serve as a guideline. For a more fully detailed listing of all available forms and options click here. You may need to ask your credit card company to process the form. There are four different versions of each of the forms that are needed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506-A El Cajon California, keep away from glitches and furnish it inside a timely method:

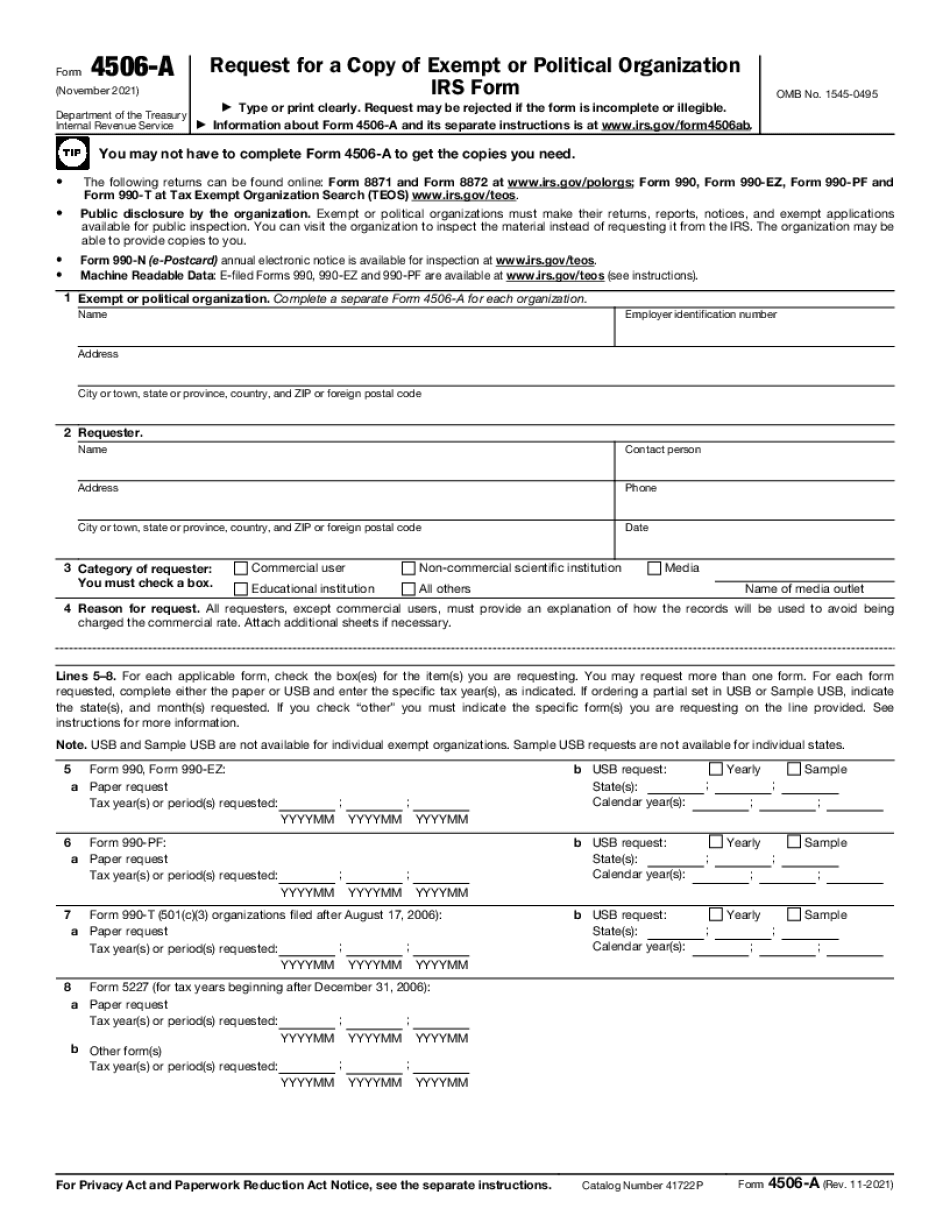

How to complete A Form 4506-A El Cajon California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506-A El Cajon California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506-A El Cajon California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.