Now, I'll be the first to admit that sometimes on the surface, the conditions and requirements for getting approved for a mortgage loan seem to be a little bit overkill. For example, why do we need the W2s, tax returns, pay stubs, a written verification from your employer, and proof of the IRS's records? That's a lot of documentation just to validate your income. Unfortunately, those are the requirements from the investors. The investors are ultimately trying to make sure that the loan is going to be repaid, and we're under a lot of regulation to ensure that your ability to repay a loan is satisfactory. We try to obtain a lot of this documentation upfront or as quickly as possible, preferably before you go under contract and start looking for a home. This ensures that we've cleared any hurdles and overcome potential problems that may arise later. In our experience, we've seen examples where the IRS didn't have a record of the tax returns that were filed – it was a result of the CPA, for example, not properly filing the taxes. The IRS never received them. Therefore, we try to do as much as we can upfront to prevent any heartache when you are under contract and getting ready to move into the house with your family. You wouldn't want to have all your belongings packed and the moving trucks in front of the door, only to discover traps that could have been cleared beforehand.

Award-winning PDF software

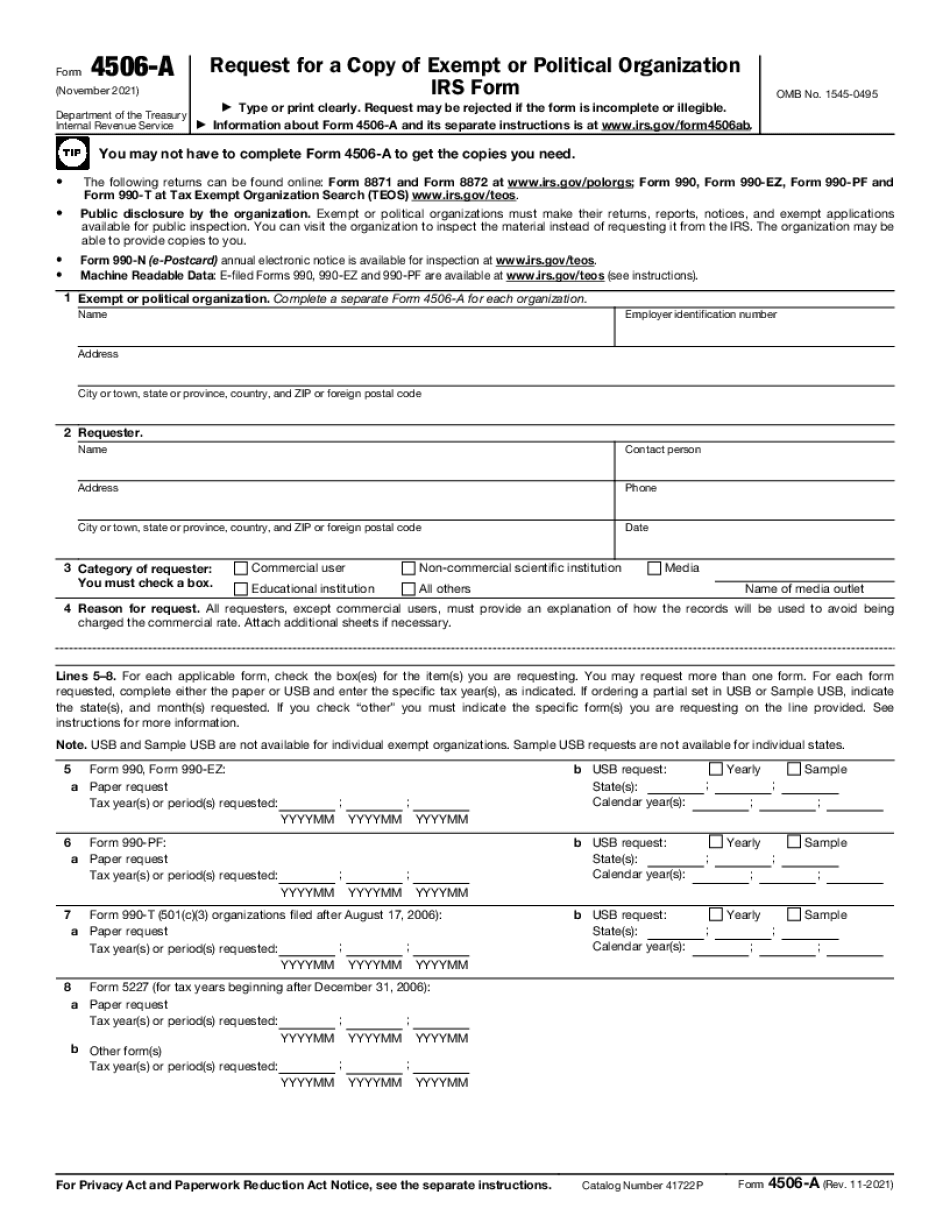

What does A 4506 t look like Form: What You Should Know

Use Forms 8718 and 8621 as necessary documentation of the organization's exempt status.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What does A 4506 t form look like