If you were selected for verification for financial aid you will be required to prtax transcripts to Wentworth in order to request the copy of your tax transcript visit the IRS website at WWF gov once on the IRS website under the tools section click on order a return or account transcript on the next page under step 3 click on order a transcript the IRS warning will appear once you have read through the entire warning click on OK to continue on the next page you'll be prompted to enter your personal information it will ask for your social security number date of birth street address and zip code please be sure that when you enter your street address your address matches the address you provided when you filed your most recent tax return once you're finished click on continue on the next page under type of transcript select return transcript be sure to select the most recent tax year click continue you're finished the IRS will send you a copy in 5 to 10 days once you have received it submit it to the student service center for more general information of financial aid visit our website at www.att.com/biz.

Award-winning PDF software

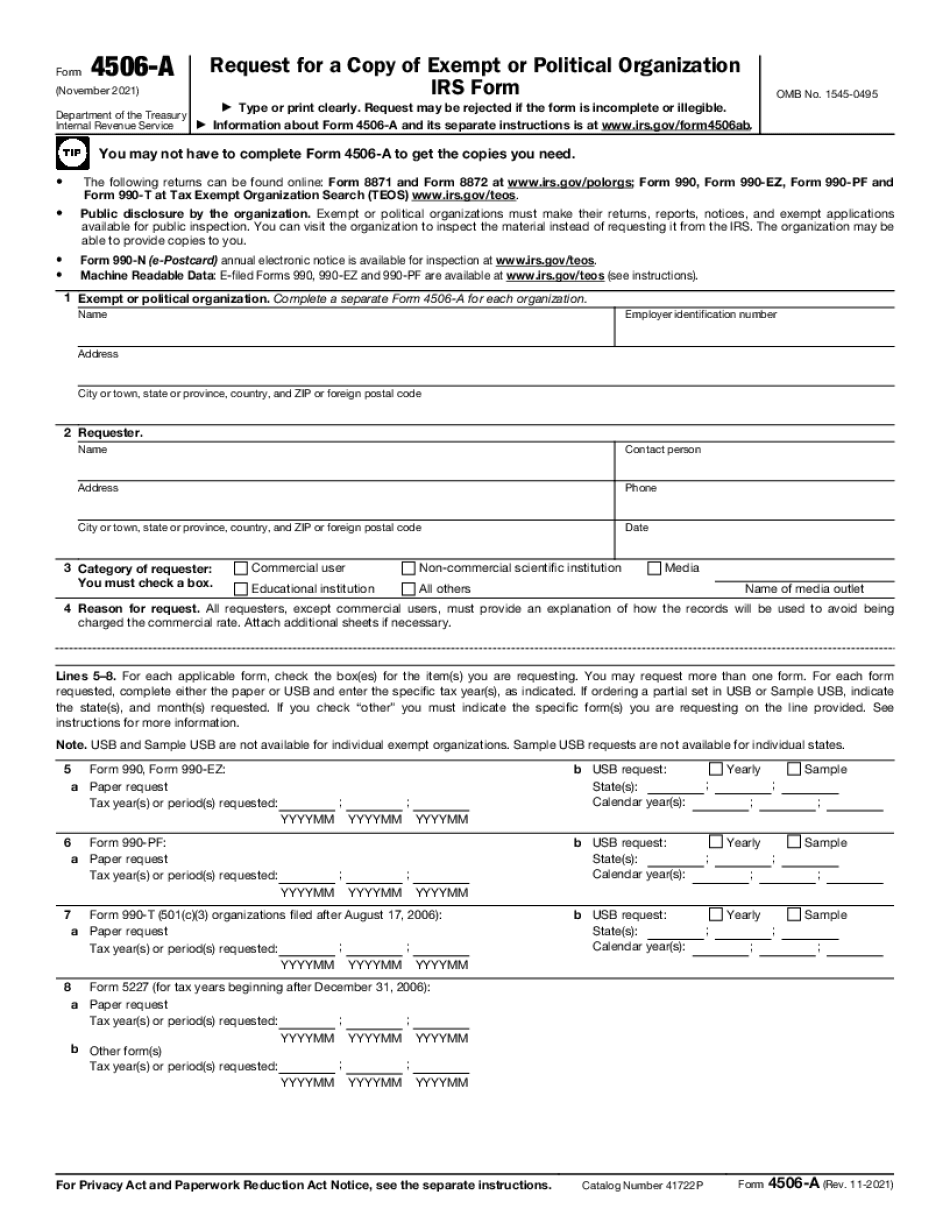

Irs 4506 revised 7 2025 Form: What You Should Know

Appendix II, List of Codes, Section 1614 or Section 4602, Statement of Accounting Methodology. Information about the Code referenced therein is available at Sea IRM 21.1.1.13.3.4(1) for information about how to report a Form 4506-T return, and IRM 21.1.1.16.7(9) for information on how to Income Tax Returns and Taxpayer Accounts Form 4506-T. IRM 21.5.18.23.1, General Taxpayer Instructions for Individual Tax Return, and IRM 21.5.18.11.3, Use of Form 4506. The information below is for Form 4506, Request for Copy of Tax Return — IRS. This application can be downloaded and used to request: Copy of a return, or Form 1040. Form 1040A requires a Form 4506 to be filed with the return and a new return form must be filed for any changes to income. For some taxpayers, additional information is available on the Form 4506-T. In addition, the information on Form 4506-T-EZ can be accessed on the following Taxpayer should first check the box on Form 4506-T to indicate that they request a copy of a tax return or the information can be located on the Taxpayer Page 1 of 2 Taxpayers who complete this application and file a complete copy of Form 4506 will receive one copy of the IRS copy of the return(s). A return that is incomplete and does not include an itemized list of items of income and/or deductions will have an IRS response stating “no copies available”. Taxpayers who are required to file income tax returns and/or tax returns containing a Form 4506-T, or any form for which a Form 4506-T is the prescribed form, may use a copy of the return(s) as an item of record for filing the return(s). If a taxpayer does not complete a completed Form 4506-T, the IRS is not required to send the taxpayer copies of the return(s). See IRM 21.1.6.6.3.3, Copy of Tax Return for Information from the IRS. This application is only for Form 4506 that is used to request copies of your federal tax return, or to designate a third party (designated person) to receive a copy.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 4506 revised 7 2025