Hello everybody, John Hudson here with Premier Nationwide Living. I hope you have a wonderful day. Well guys, we've got a little bit of good news, and that is that we will go ahead and still fund a loan with a 40-50-60 signed by your borrowers, as well as verification of either a tax refund or a canceled check for a tax payment. So, I mean it's a little bit of help in this current situation with our government being shut down right now. The bad news is that, well obviously USDA is still shut down and you know, I think it's a travesty, man, we've got to file in our office right now. We're literally going to borrower with five kids that are essentially homeless right now because we can't get anything back from the USDA because they're shut down as part of this whole mess. Everything that I've read, my sources tell me up there in DC, is that really this one actually might be in for the long haul, so not good for anybody. I still urge you guys to pick up your phone, call your congressman's office, and at the very least get them to find a way to fund the government and get the doors opened up again. But again, I just want to reiterate, in the meantime, we will fund your loans, conventional FHA VA, as long as we have a signed 40-50-60, as well as proof of either a refund or tax payment. Same goes for your social security verifications, we're going to get a little old school, or if you have a copy, that we're going to want to see a copy of the social security card, as well as one proof of ID to go along with that. So anyway, you...

Award-winning PDF software

Irs 4506t-ez Form: What You Should Know

Taxpayer Identification Number (TIN) for Form 4506-EZ you must use the same form (Form 4506T-EZ or Form 4506-T.) to order. For more information, refer to the information on IRS.gov about Form 4506-EZ. For information, or to order, see Form 4506T (formerly Form 2555), Form 4506T-EZ (Rev. 10-2021) — IRS Form 4506-T-EZ. (November 2021). Department of the Treasury. Internal Revenue Service. Short Form Request for Individual Tax Return Transcript. About Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript — IRS Aug 26, 2025 — Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following For instructions on how to fill out the Form 4506T-EZ or for more information on how to use Form 4506T-EZ for tax return Information about Form 4506-T, Request for Transcript of Tax Return — IRS Aug 26, 2025 — You can use Form 4506-T (formerly Form 2555) to order tax return transcript information or other tax information. Form 4506TS. You can use Form 4506TS to request information on a tax return. Form 4506TS is not a substitute for a tax return transcript. Use Forms 4506TS, Request for Tax Return Transcript, or Order Tax Return Transcript — USCIS. You may also mail a request with Form 4506TS to: Form 4506TS. Department of the Treasury. Internal Revenue Service. How to Complete Form 4506-TS (Rev. 5-2001) — USCIS. Form 4506-T. Department of the Treasury. Internal Revenue Service. Short Form Request for Individual Tax Return Transcript. How to Fill Out Form 4506-T (Rev.

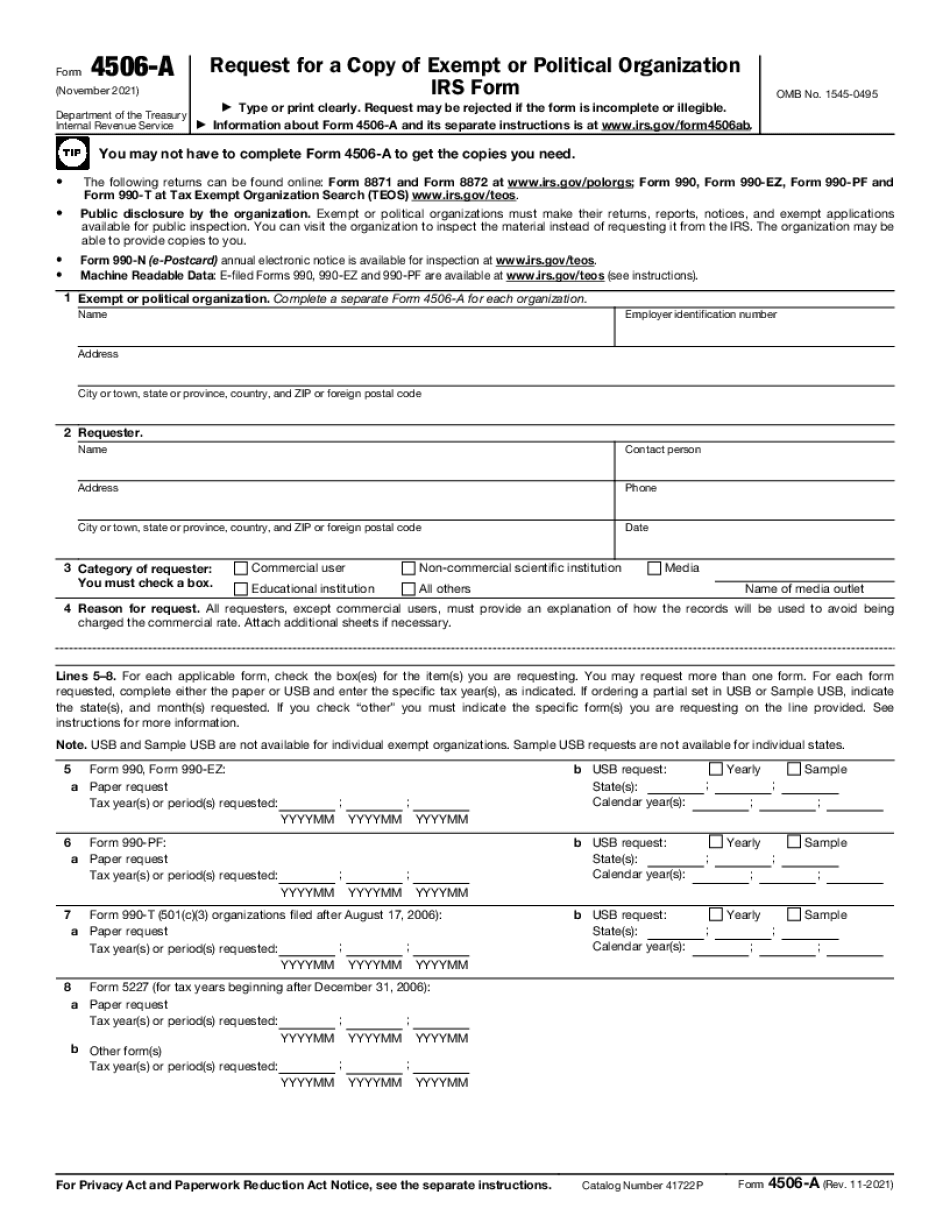

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 4506t-ez