Thank you for joining us in mortgage navigation comm. We're going to be talking about the 4506 e-z. This is different from the 4506 t form and it's a little bit simpler, so we're going to run through it very quickly. Number 1a is your name. To a, if your spouse is on the return with you, his or her name would go there as well. Also, include the social security numbers in 1a and 2b. Your current address should be provided in 1a and 2b, unless you've moved since your last return. If that's the case, on item number three, you would put your current name and address. On number four, make sure to add your previous address that matches the one on your tax returns. Number six indicates the years that you're requesting. It's important to fill this out correctly because it should be the last day of the year for the tax year you're requesting. For example, if you're requesting 2011, you would write 2011. Make sure you fill that out for each one of the tax years you're requesting. At the bottom here, make sure that you sign and your spouse signs if they are on the return, regardless of whether or not they're on the mortgage. If your spouse does not sign, this is the number one thing that people miss and it will result in your form being sent back. Finally, don't forget to include your phone number at the bottom right-hand corner. Thank you for your participation, and make sure to visit mortgage navigation com.

Award-winning PDF software

4506-t mortgage Form: What You Should Know

Community Tax SBA-1722.

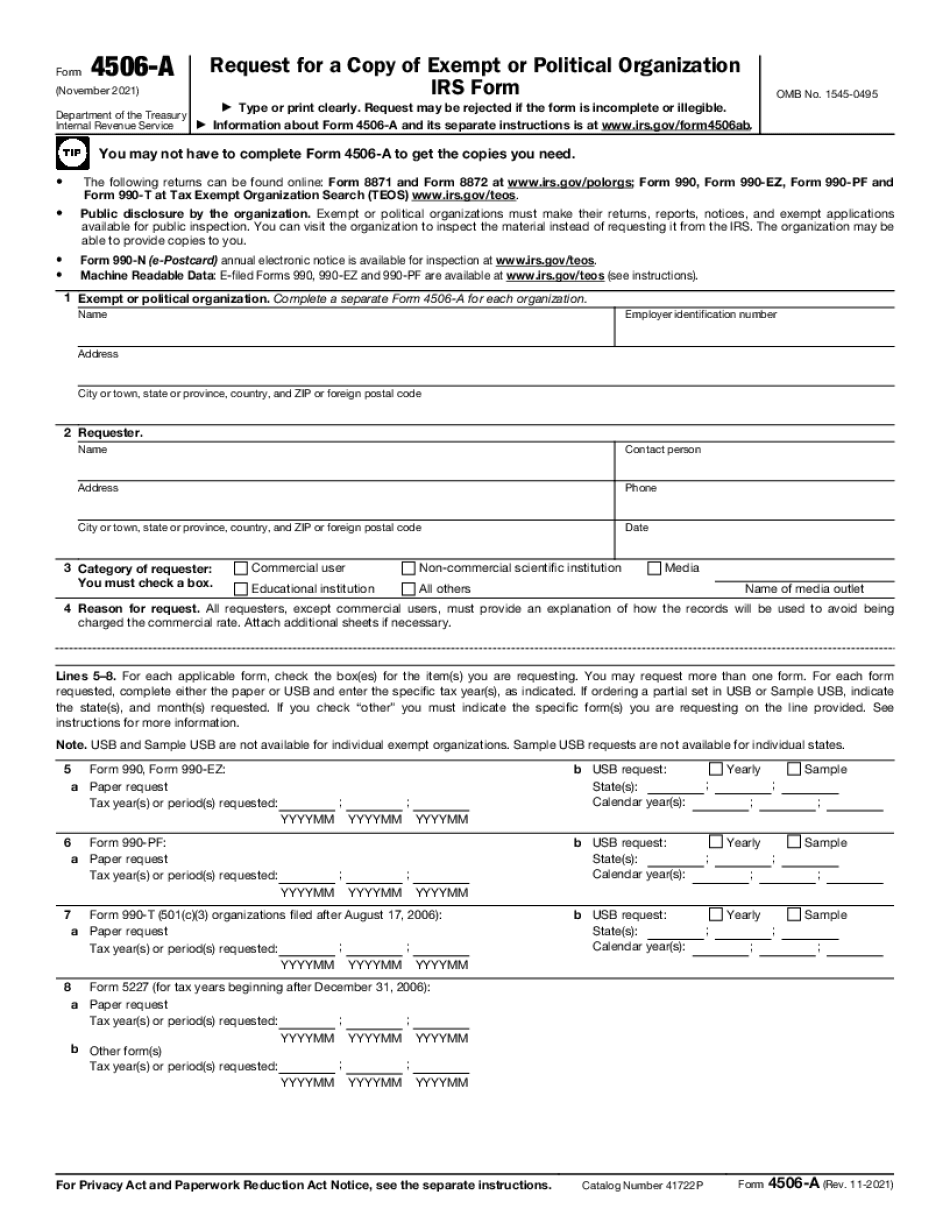

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 4506-t mortgage