I already saw Dave Sullivan here for The Credit Guy TV. I wanted to talk about the credit rating of the US government again. I did a video a while back where I actually ran the government's situation through my FICO credit score estimator and got a real FICO score for the US government. You can watch that video here. But I also wanted to talk about the government being shut down and the inability to get IRS tax return verification services. You see, when you apply for a mortgage, your income taxes are verified by the IRS. However, since they're currently shut down, they are unable to provide these verifications. As a result, many lenders have put that process on hold and are waiving that requirement in order to close on a mortgage loan. However, if you're working with an investor that has not waived that requirement yet or if you're putting things on hold, here's what I suggest you do: Go ahead and order your 4506 teas now and get them to your service provider. They are still putting them together and sending them to the IRS. By ordering now, you'll be ahead of the rush that will come once the government shutdown is resolved. Normally, it takes about a day or two to get the verifications back. But with each day that we delay, the IRS falls another day behind in their work. Currently, they're about nine days behind. So, if you want to get ahead of the rush, make sure to order your 4506 teas now. Even though you won't get them back immediately, you'll be in a better position once the rush begins. So, if you have 4506 teas that you're going to need, I strongly recommend ordering them now. This way, you'll be ahead of the rush and...

Award-winning PDF software

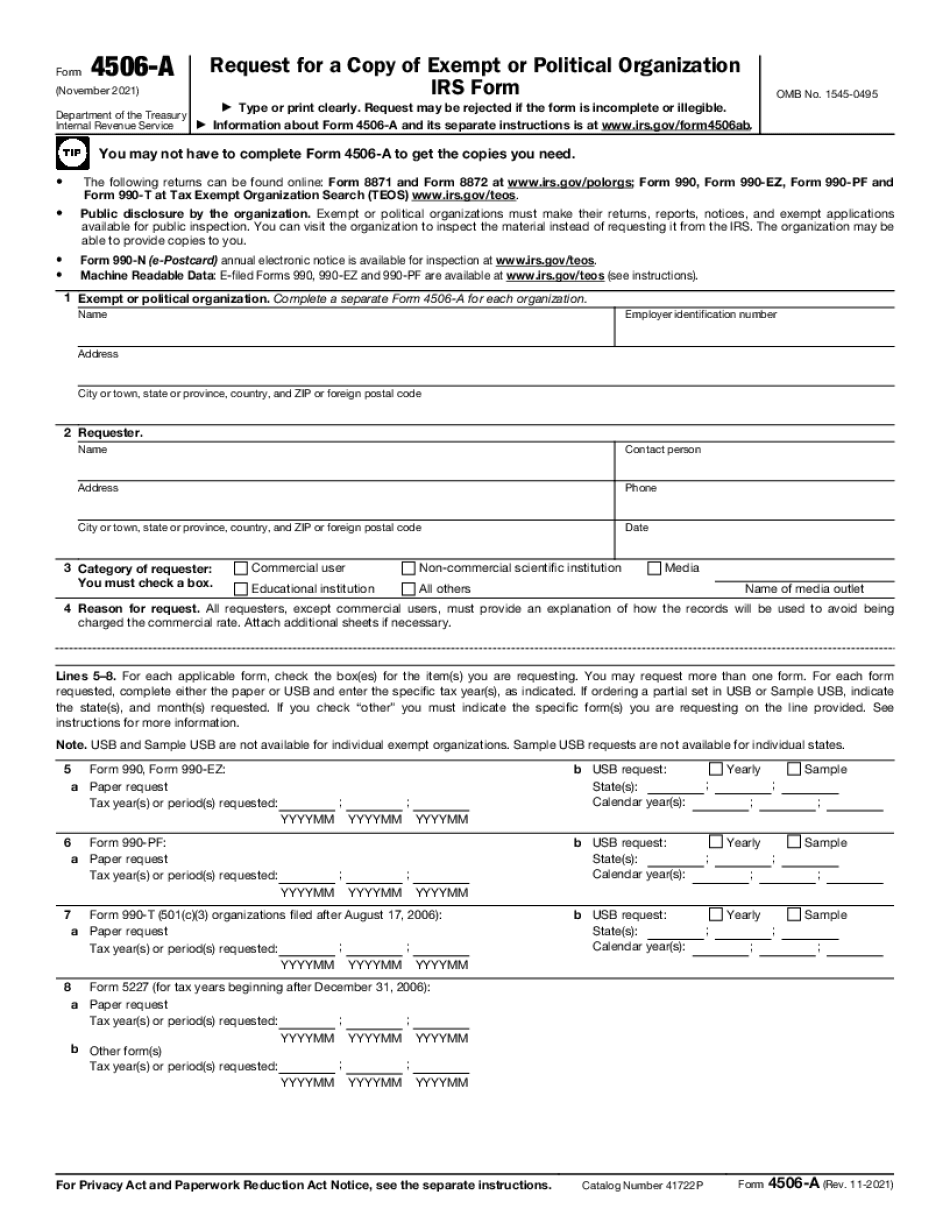

How to fill out the 4506 Form: What You Should Know

Get your copy What to include with 4506-T Form 4506’T You will need to provide the following information by filling out Form 4506T: Complete a new Line 11, including your name and SIN For Line 15, enter the TIN on your tax return. What to do if not receiving your form If you have not received your 4506-T, please contact us at [email protected]. If you have already requested a copy of your tax returns, the IRS will be able to help you locate a replacement form. Loan Processing See Also For a complete list of IRS Forms and Instructions, go to: For a complete list of IRS Forms and Instructions, go to: Get Transcripts Online from the IRS For a complete list of IRS Form 4506 — Tax Return Transcripts, go to: Other helpful Tax FAQs for Individuals Lending Club Transcript Request Lenders who receive a portion of their funds from a customer should: Notify the individual they are repaying their loans by mail. (See How to Pay Your Federal Tax Bills or The Home Mortgage Disclosure Act.) Notify the individual about the amount and date the borrower or customer received a refund and, at a minimum, an itemized list of items to be included on their federal tax refund form, including: all taxes (payable on the same payment schedule) other than the first 50 of the refund (if you withheld over 25) for which you are withholding or applying any additional taxes (if applicable) for which the borrower or customer must repay you Keep documents that confirm the borrower or customer's identity and address for three years after you receive it.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill out the 4506 form