It's coffee talk on FM 94 7 and AM 1450 KBKW. - It's time now for another edition of The Insider Reports with Ever Hughes. - Good morning, everything going well? - Anything interesting going on? - Well, actually, something interesting happened. - It was by accident, I was with a friend yesterday and we went home after church. - He fed me on his deck overlooking Hood Canal. - Then he brought out and we watched the football game. - It was a good game, actually, it was an excellent game. - But anyway, he brought out this letter from the IRS. - The IRS said they wanted him to fill out a change of address form and another 4506. - A 4506 is a form a lender makes you sign when considering giving you a loan. - By signing it, you authorize the lender to access your transcript information with the IRS. - Some people may think, "I've already given them my tax returns, what more do they want?" - Well, here's what they want: They don't believe you. - That's why they want the 4506 or whatever it is, to verify the information. - The lender wants to see if what you told them is really what you sent to the IRS. - Trust but verify is what you're doing here. - But, in this case, the lender made a mistake on the 4506. - They didn't put down his address, they put down the address of the property location. - So when the IRS received the form, the address didn't match the taxpayer's address of record. - The taxpayer was using a P.O. as his official address. - This is important to note when getting a loan. - It's not just for car loans or house...

Award-winning PDF software

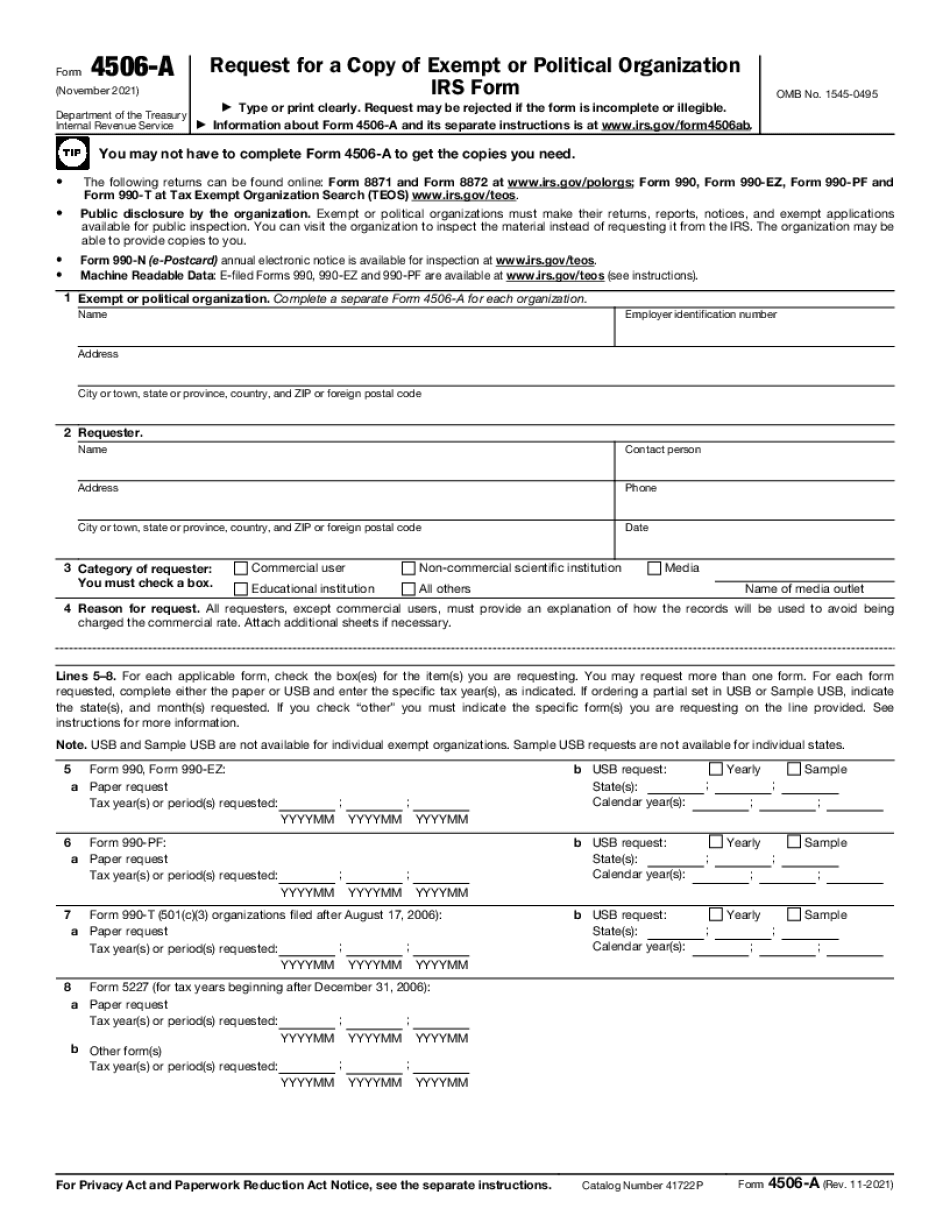

Irs 4506-a where to fax Form: What You Should Know

Instructions for Form 4506-A (Rev. 4-2017) — IRS Reasonable time: • Please provide a written statement to the IRS, with your Form 4506-A, with the letter that identifies the group for whom the letter is being requested. • Do not send the request to: • The exempt organization • The political committee. Please allow 2 weeks for processing the requested tax returns. Requesting a copy of an exempted organization's return or Notice of Exemption • Please provide a written statement to the IRS, with your Form 4506-A, with the letter that identifies the group for whom the letter is being requested. • Please provide a letter from the exempt organization, or the political committee, to the office of your State Director. If the exemption letter states that: • You may request a copy of its return, • You may request a copy of its return or notice • You are entitled to a copy under section 6104 of the Internal Revenue Code, or, • You are entitled to copies in the specified format Please do not send a request to the following offices: Agency, office, or person where the organization files its tax return, report, notice, or application. • Please provide a written statement to the IRS, with your Form 4506-A, with the letter that identifies the group for whom the letter is being requested. • Do not send the request to: • The exempt organization • The political committee. Instructions for Form 4506-A (Rev. 4-2017) — IRS Requests made to: • The political committee or to an office of the State Director of the organization or organization's authorized representatives in the State. Note: Please allow 14 calendar days for requests sent to: Political committee, office of the State Director (section 6120(c)(4) of the Internal Revenue Code) where the organization files its tax return, report, notice, or application. Please include: • A written statement that describes the documents that you are requesting and the reasons you need copies of these documents. • Copy of your tax return. • Copy of your notice of exemption under section 6104 of the Internal Revenue Code. • A signed statement certifying that all information provided with your request has been provided by the organization to the IRS, and that no IRS audit of or other action affecting the organization has occurred.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 4506-a where to fax