Music to access the new assigned 4506-T setup, you can access it two ways. First, you can go down to your disclosure long form and click "Request for 4506-T". It'll bring you to the new version. Secondly, you can go to the forms menu and just request for transcript of text. A couple of changes have been made. This now allows one to assign from multiple versions of the 4506-T to go out with disclosures or separately per borrower. So, if your borrower file is different two years in a row (e.g. they got married, they changed an address) and you need multiple 4506-T forms, you can now have all of your forms listed without having to overwrite any. The first one will always be templated for you and it'll have borrower/co-borrower on it. If there are any changes that need to be made manually, it'll also give you this piece of the template. For the first borrower, it's pretty much done. There should be a little bit of intervention only if you know that there are changes to the way they filed prior 4506-T. To request a 4506-T for multiple borrowers or have multiple 4506-Ts for a single borrower, there are a few steps to follow. To have multiple for a single borrower or a single application where there's a borrower and co-borrower, you'll click on the "Add Sign" and create a new entry here. Drop-down "Borrower" or "Co-borrower" accordingly. So, if I just want to make another one for the borrower by himself, I'm going to hit "Copy", go down to section 5, it will bring up your contacts. You'll hit "Clear" in the corner and then grab advanced data from the list like this for you. Select the type of transcript you're going to be requesting and...

Award-winning PDF software

4506 processing time Form: What You Should Know

IRS Form 4506-T — FAQs Definition Key Takeaways · It is the individual tax return that has the information you need to know (tax codes, tax categories, tax due dates, etc.) · If you filed online, you will need to contact your original source of income or payroll firm to request your tax return. • Form 4506-T is for information or copies of any or all tax returns or schedules filed with the IRS by the individual in question. · Form 4506-T is not a substitute for a tax return. The return you provide to us will usually contain the information that is essential to complete your return. · If you are filing online through Metal, we will make the information on your tax return available to you in your online account when you log in to complete your return. If you are filing through an IRS service center (like a branch), your tax return and information will generally be available in seven to 10 days. Where to Get Form 4506-T — H&R Block The following is a list of all the tax return forms that you can get from H&R Block (H&R) Block is an IRS affiliate (an affiliate of the IRS). When you order a service from H&R Block, we are using the IRS Form 4506-T. H&R Block does not offer its own tax forms. What Does Form 4506-T Do? · This form provides you with all the information needed to complete your tax return. · You need to provide a tax professional with the information provided on this form, so make sure that the person you need to contact has it. · The form also allows you to report estimated tax, or, if you file electronically, estimate tax. This form is only used for persons who have not filed their own income tax return through the regular income tax reporting process. · Do not include your own tax information on this form. · If you believe you are owed tax, or you wish to get a tax payment, complete and send to the mailing address on the front of this form. To find your mailing address, go to the IRS website and enter “Form 4506” in the search box. · If you have questions or need further assistance, call toll-free in the U.S.

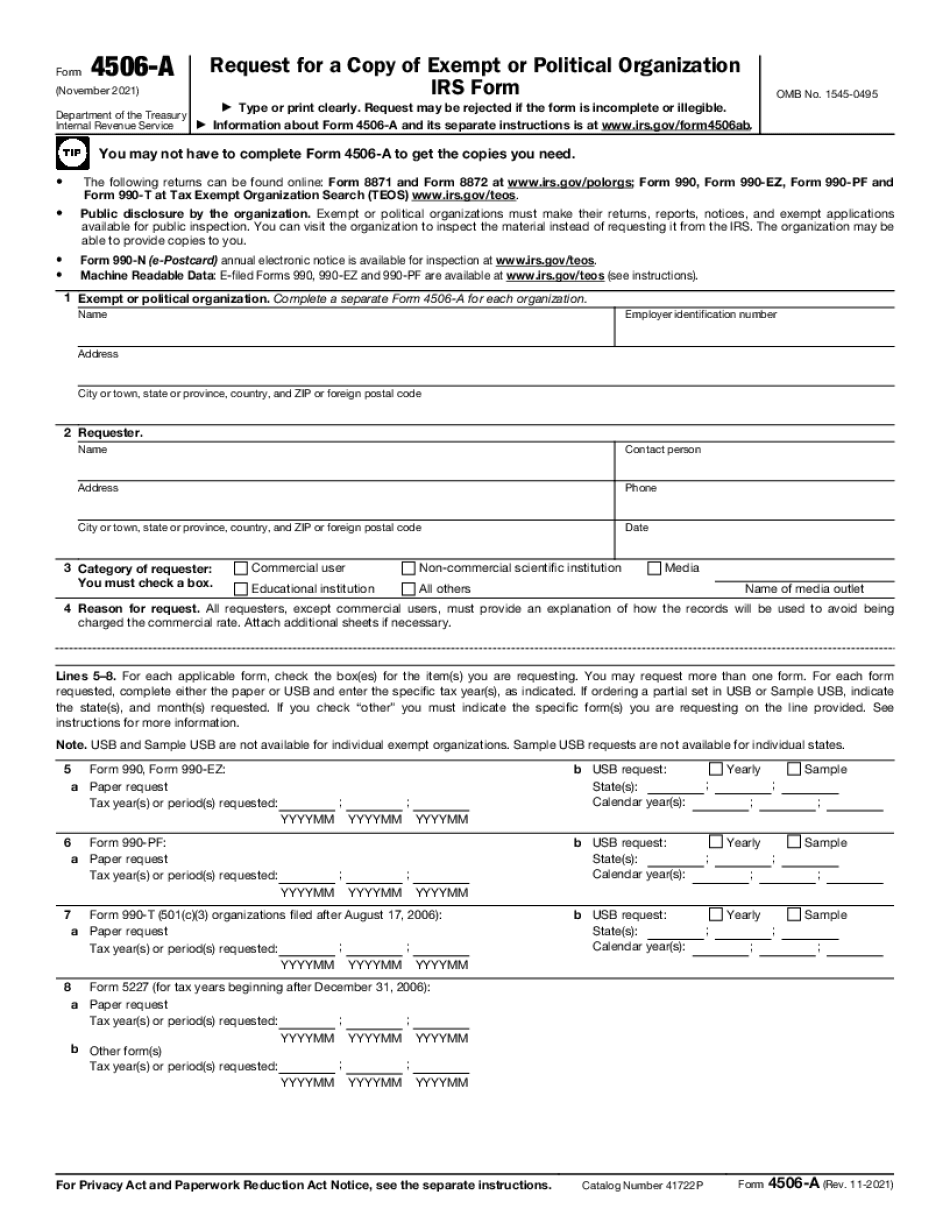

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4506 processing time